When you first dive into real estate investing, you’ll come across two acronyms a lot: LTC and LTV. These are two crucial formulas that help you calculate your maximum loan amount.

A Loan to Cost (LTC) ratio represents the amount of financing a lender will provide relative to the project’s cost. Loan to Value (LTV), on the other hand, compares your loan amount to the property’s value. Understanding both formulas is key to deciding if an investment is worthwhile.

Let’s break down the difference between LTC and LTV so you know which formula to use as you evaluate your next investment.

What Types of Projects Utilize LTC and LTV?

While LTC and LTV look similar on paper, they’re relevant to different kinds of projects. LTC is typically used for new constructions and major renovations. On the other hand, LTV calculates the maximum loan amount based on the value of an existing property.

Here’s what that looks like in practice:

Projects That Use LTC

Lenders use LTC for investments that include a construction budget. They often preset LTC, representing the percentage of the budget they are willing to cover. For example, when you invest in new construction with an 80% LTC, your loan covers up to 80% of the total cost.

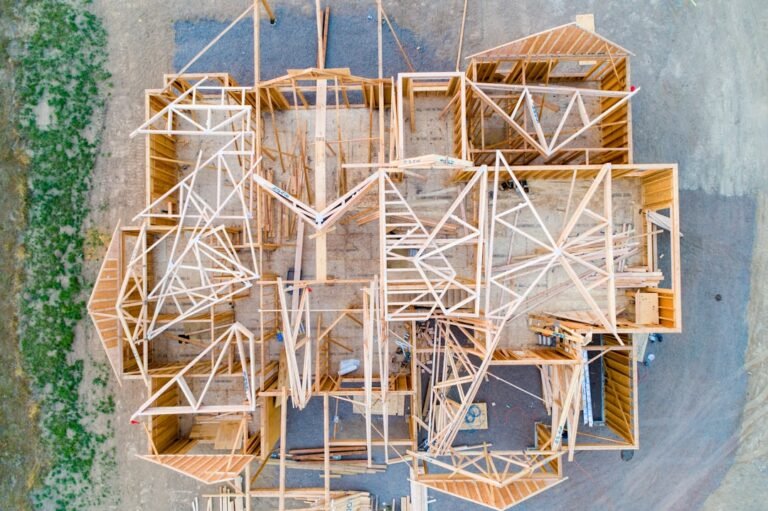

Lenders apply this to new commercial and residential constructions, as well as investment properties that need full-scale renovation.

Projects That Use LTV

LTV helps you calculate the maximum loan amount based on the final value of a property, rather than construction costs. This ratio is used for existing properties that require little or no renovation before sale. For example, if your LTV is 80% for a prospective investment, you can expect a maximum loan of 80% of the property’s value. This leaves 20% to be paid up front by the investor.

LTC and LTV in Action

Let’s look at a few real-life examples of LTC and LTV for different types of real estate investments.

New Construction

Say you’re investing in a new ground-up construction with a total cost of $500,000. You compare two investment lenders:

Standard lender: The average bank or lender offers an 80% LTC, leaving you with $100,000 in out-of-pocket costs. Dominion: Dominion Financial offers up to 90% LTC on ground-up construction projects, leaving you with only $50,000 in out-of-pocket costs.

Fix and Flip

Next, consider a flip project with a total cost of $300,000.

Standard lender: With an LTC of 80%, you’re left with 20% of the project, or $30,000 out-of-pocket.Dominion: Dominion offers up to 100% LTC for renovations, leaving you with no out-of-pocket costs.

Multifamily Bridge

Multifamily bridge loans provide financing for a large-scale residential investment. Here’s an example of bridge loans for an investment with a value of $1,000,000.

Standard lender: An average lender may offer up to 75% LTC for a multifamily investment property, leaving $250,000 in out-of-pocket costs. Dominion: Dominion Financial offers up to 85% LTC for their multifamily bridge program, leaving $150,000 out-of-pocket.

Why Choose Dominion Financial?

Comparing the examples above, it’s clear why Dominion Financial is the best choice for your real estate investment loan. They offer up to 100% LTC and 80% LTV for most projects. That means less upfront costs to you — the investor — and a higher return in the long run.