How Lenders Price Rates On Loans

But how does the yield curve impact your loan rate? When you borrow money, your interest rate is the sum of a benchmark rate (like Treasury yields) plus the lender’s “risk premium.” This difference between what the lender charges and the Treasury rate at the same maturity is called the “credit spread.”

Here’s a quick example on a two-year loan: if you pay 6.5% when the two-year Treasury yield is 4.5%, the credit spread (i.e. the risk premium lenders charge above their cost of capital) is 2%.

Hard Money Loan Rates and Volatility Rise

Short-term reference rates have risen drastically in a very brief period of time, increasing borrowing costs. Let’s take a look at how market conditions are changing loan rates.

Fix & Flip loans

For investors borrowing hard money loans or bridge loans for fix and flip projects, the reference point on the yield curve is the 1-year yield.

The 1-year Treasury yield has surged 4.15%, rising from 0.4% in January to 4.55% by October 28, 2022. This sharp increase unfolded quickly, with the rate at just 0.9% in March and 2.8% in July. Some bridge lenders have raised rates cautiously, absorbing part of the rising cost of capital. Others hesitate to match the full Treasury yield increase, concerned about retaining customers. For borrowers, this divergence among lenders offers opportunities to compare rates carefully.

DSCR loans

Debt service coverage ratio (DSCR) loans are generally priced off the five-year Treasury yield, whether it’s a 30 year loan or 5-1 ARM. The reason is that these loans have historically been paid off within five years.

Most new DSCR loans now carry a 5-4-3-2-1 prepayment penalty structure. For borrowers seeking a 3-2-1 structure, your loans actually cost more, because bond investors who buy these loans prefer a longer duration. (Even though, ironically, the three-year yield is currently higher than the five-year.)

During the “good old days” in January, the rates on DSCR loans were priced using a mere 1.4% yield as a reference point. Since then, the five-year Treasury yield has spiked to 4.2%, or nearly 300 basis points higher. As a result, many DSCR loan rates have risen from around 5% to 7% or even 8%.

Residential Mortgages

Conventional mortgages like residential consumer loans are priced off of a Treasury rate somewhere between the 5 and 10-year yield, depending on the loan. For the overall residential mortgage market, the 7-year yield may be a reasonable reference point.

Market Volatility

Lenders have also gotten more conservative in pricing rates. Volatility has picked up because rates also depend on the investors who buy these loans.

Bond buyers who purchased real estate loans this year have done so against a rising tide. (In short: while this month’s yields are higher than last month’s, next month’s yields could be even higher.) Increasing rates have meant that the value of these loans dropped and bondholders have been catching a falling knife all year. Bondholders are therefore requiring a bit more risk premium, i.e. a higher credit spread.

Due to this pattern of rate hikes and bondholder losses, lenders have had to readjust their pricing accordingly. For real estate investors, that spells double trouble: while the index reference yield has spiked sharply, the credit spread charged on top has also risen.

How to Get the Best Rates

Now, we’ll take a look at how to use the concept of risk premiums and the yield curve to score the most competitive interest rates.

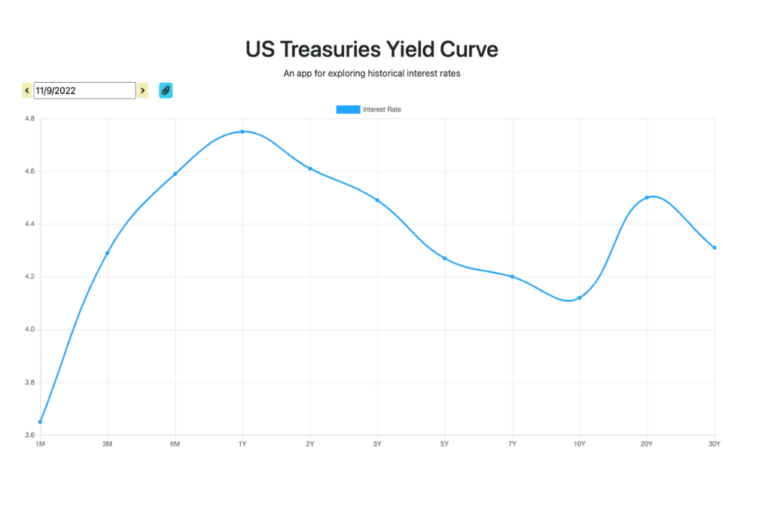

We’ll start with the US Treasury Yield Curve, a simple and useful website that allows you to plug in a date and see the yield curve from then. You can use these numbers to determine the risk premium a lender tacks onto your loan.

For instance, on a 1-year loan, how much are you paying over 4.55%? For 5-year loans, what is the lender charging in risk premium over 4.2%?

Think about all of your loan quotes as a function of the credit spread (risk premium) over the appropriate Treasury yields. While lenders don’t have control over the Treasury reference rate, they can control the credit spread. As a borrower, your goal is to minimize that risk premium.

To get the best deal, compare loan rates to Treasuries and seek the lowest credit spreads. Better yet, you can compare loans of different maturities.

Say you get a quote of 6.5% on a 10-year loan. At that rate, your risk premium is 2.5% above the 10-year yield of 4.0%.

Now let’s say that another lender offers 6.5% on a 7-year loan(where the Treasury yield is 4.1%). While the interest rate seems to be the same, the credit spread on the 7-year loan is slightly smaller – 2.4% – compared to the 10-year loan.

That makes the 7-year loan a better deal, from a risk premium standpoint.

Hopefully, interest rates are getting closer to their peak – but don’t hold your breath. In a rapidly changing market, understanding how lenders price rates helps you make savvier loan decisions.

Looking for competitive rates? Get pre-approved for a Dominion Financial Services loan today.