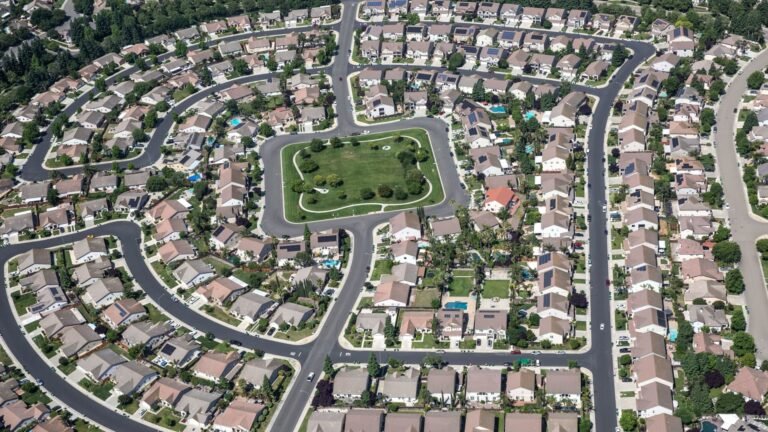

A new housing development built along a canal near the Mokelumne River is viewed on May 22, 2023, near Stockton, California.

George Rose | Getty Images

Mortgage rates are rising sharply this week, as investors sell U.S. Treasury bonds at a swift pace. Mortgage rates follow loosely the yield on the 10-year Treasury. Some speculate foreign countries could be dumping U.S. Treasuries in retaliation against President Donald Trump’s sweeping tariff plan.

But there is another, even bigger, concern for both mortgage investors and for the all-important spring housing market. What if China, one of the largest holders of agency mortgage-backed securities (MBS), decides to sell those holdings as well in response to the U.S. trade policies. And what if other countries follow?

“If China wanted to hit us hard, they could unload treasuries. Is that a threat? Sure it is,” said Guy Cecala, executive chair of Inside Mortgage Finance. “They’re going to look at pushing levers and trying to put pressure … Targeting housing and mortgage rates is a powerful driver of something like that.”

At the end of January, foreign countries owned $1.32 trillion worth of U.S. MBS, or 15% of the total outstanding, according to Ginnie Mae. The top owners: Japan, China, Taiwan and Canada.

China had already begun selling off some U.S. MBS last year, with the country’s holdings at the end of September down 8.7% year over year and down 20% by the start of December. Japan, which had shown gains in its MBS in September, showed a drop at the start of December.

If China and Japan were to accelerate those sales further, and if other nations were to follow, mortgage rates would rise even more than they are now.

“The concern, I think, is on folks’ radar screens, and being raised as a potential source of friction,” said Eric Hagen, mortgage and specialty finance analyst at BTIG. “Most investors are concerned that mortgage spreads would widen in response to either China, Japan or Canada coming in with a retaliatory objective.”

Widening spreads mean higher mortgage rates. The spring housing market is already floundering amid high home prices and weakening consumer confidence. Given the recent stock market rout, potential buyers are increasingly worried about their savings and their jobs. A recent survey from Redfin found that 1 in 5 potential buyers sells stock to finance their down payments.

Hagen said selling of MBS by foreign entities could further spook the mortgage market.

“The the lack of visibility for how much they could sell and their appetite for selling, I think that that would scare investors,” he said.

To add to the pain, the U.S. Federal Reserve, which is a major owner of MBS, is currently letting that MBS roll off of its own portfolio, as part of an effort to shrink its balance sheet. In other times of financial crisis, like during the pandemic, the Fed was buying MBS to keep rates low.

“That is a source of potential pressure on top of this whole conversation,” Hagen added.