Rent costs have long weighed on lower-income households — now it’s coming for the middle class.

Nearly 4 in 10 middle-class renter households are burdened by costs, an NBC News analysis of Census Bureau data found. That’s up almost 20% since 2019, while the already high share of cost-burdened, low-income households rose just 2%.

A cost-burdened household is defined as one paying 30% or more of pretax income on rent and housing costs. This figure is widely used as a threshold for affordability: the Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

“If you’re spending more than 30% of your income on rent, it’s going to be harder to pay for everything else,” said Peter Hepburn, associate director of the Eviction Lab at Princeton University, “it makes you more vulnerable to all sorts of bad things.”

While paying rent has always had its sting, experts say the tight housing market of recent years — which is also squeezing homebuyers — has caused the pain to bleed into new income brackets.

“Being cost-burdened has been a fact of life for lower-income renters for a long time,” Hepburn said. “It’s really just in the last five or six years where these numbers creep upwards for what we think of as middle-class renters.”

Some economists define middle-class households as those earning between 50% and 150% of the median income, or $40,000 to $121,000 a year. Of the more than 40 million renter households in the Census Bureau survey data, middle-class households account for 20.1 million — roughly 7.8 million of which are cost-burdened ones.

Daniel Evans checks his bank account twice daily — once in the morning and again before going to bed. Despite earning a middle-class income as an audiovisual technician in Tennessee and consistently landing promotions, the 35-year-old still needs roommates to afford rent.

When he moved from Memphis to Nashville for a job in 2016, rentals in even the nicest areas were still in reach. Since then, however, salaries haven’t kept pace in Nashville or nationally.

“Median rents have gone up 23.4% where median incomes have gone up by 5%,” Hepburn said.

Evans has seen this firsthand: Despite a promotion, he wasn’t able to escape his cost-burdened situation until a friend intervened. In early 2023, he moved in with the friend, who is also his landlord, whom he met playing soccer. The friend cut him a deal on rent, Evans also helps out with tasks such as property maintenance.

Not everyone is so lucky. Typically, renters struggling with costs have fewer options — especially compared to homeowners.

“We’ve added a lot of safeguards to make sure that people with a mortgage aren’t at a risk of foreclosure immediately if they fall behind,” Hepburn said. “But for renters, there’s no equivalent.”

Renter vulnerability is made worse by housing shortages as well as private equity firms– particularly shortages in affordable and near-affordable housing — which allow landlords and developers to charge more.

“[Nashville] has heated up and landlords and developers know they can get away with charging more — so they do,” Hepburn said.

It also makes it increasingly difficult for renters to achieve traditional milestones of financial security, such as buying a home.

“How do you save for a down payment if you only have a few hundred dollars left” at the end of the month, Hepburn said.

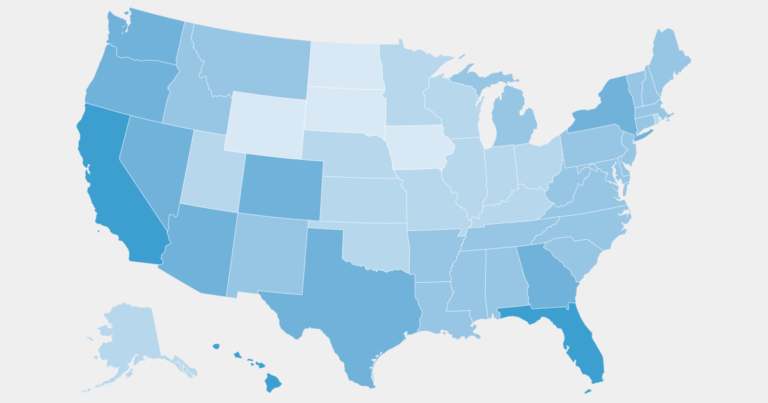

While nearly 40% of middle-class renters are burdened by costs nationwide, in Tennessee that figure is 37%, placing it among the upper half of states with the largest share of cost-burdened middle-class renters.

The growing pressure on middle-class renters may finally be spurring political action. Housing costs took center stage leading up to the 2024 presidential election, and in April, New York state enacted a law strengthening protections for renters and capping rent increases.

“Once [the middle class] starts to feel the pinch, that’s when we start to see more attention paid to this too,” Hepburn said. “What remains to be seen is, what sort of investment Congress is willing to make, because this requires a real investment.”

Until then, for Evans, despite moving into management and landing a job as a lead technician, rent eats away at his forward momentum.

“Yes, I want to progress in my career, but that’s because I want a house and a better car and a family and all those things, right,” he said. “There’s something to be said just for having your own space and making it the way you want, especially at my age.”