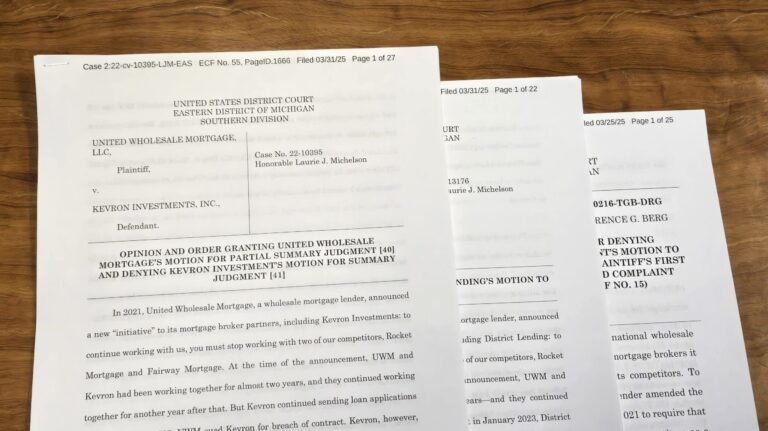

United Wholesale Mortgage (UWM) has notched a series of favorable legal rulings in litigation related to its “All In” initiative. The recent court wins include a partial summary judgment and the awarding of $70,000 in damages to UWM in a breach of contract case against Kevron Investments Inc.

UWM’s initiative, instituted in 2021, stipulates that mortgage brokers who contract with the wholesale mortgage lender must cease working with UWM competitors Rocket Mortgage and Fairway Independent Mortgage.

Under the terms of the agreement, brokers who violate the prohibition against working with those UWM competitors are subject to the greater of $50,000 or $5,000 per loan submitted to Rocket or Fairway.

Unlike Rocket and Fairway, which engage in both retail lending with individual borrowers and wholesale lending through mortgage brokers, UWM operates exclusively in the wholesale channel.

According to court filings, UWM asserted that Rocket’s and Fairway’s business model “negatively impacts consumers, brokers and the wholesale mortgage channel in general.” It added that the “All In” initiative was “necessary to protect the long-term viability of the wholesale lending channel.”

Kevron Investments, a California-based mortgage brokerage, countered that the impetus for the so-called “ultimatum” to work exclusively with UWM was a “brewing rivalry” between UWM and Rocket, according to court documents.

Kevron began working with UWM in 2019, prior to the establishment of the new contract terms. It contended that it never agreed to the amended terms and thus was not subject to penalties for 14 loans it submitted to Rocket. It also asserted that the “liquidated damages provision” of the agreement was “an invalid penalty and thus unenforceable as a matter of law,” according to court filings.

Liquidated damages are an agreed upon sum of money in a contract that one party owes to the other if a contract is breached.

In ruling in UWM’s favor, U.S. District Judge Laurie Michelson stated in her opinion on Monday that the “clear and unambiguous contract language precludes Kevron’s argument.”

The district judge added that “Kevron’s contract interpretation is unreasonable as a matter of law, and it fails to show that the liquidated damages clause is invalid as a matter of law.”

In similar UWM breach of contract cases against Atlantic Trust Mortgage Corp. and Madison Atrena LLC, district judges recently denied motions to dismiss. Those cases remain open and will proceed in the coming weeks.

“These legal victories have set a new standard for our ongoing cases and further highlight that UWM’s All In initiative remains legal,” a company spokesperson wrote in an email to Scotsman Guide.

The latest court wins follow a string of high-profile cases involving UWM. In February, Judge Michelson denied a motion by America’s Moneyline Inc. to reconsider a countercomplaint that had been dismissed. In September 2024, a judge dismissed a 2021 lawsuit filed by the Okavage Group, a Florida-based mortgage broker.